Thoughts on the AI bubble

Understanding tech cycles and what's different about AI

There’s been a lot of discussion recently about the AI bubble, usually involving a claim about whether AI is actually in a bubble and predictions on how it might pop.

Instead of doing that, I’m going to synthesize insights from across the discussion in one place—why tech bubbles form, how they pop, what feels different about AI in that context, and how to respond.

AI is going through the same fundamental cycle as past technologies, but it’s unique because it has two distinct bubble mechanisms: inflated valuations and infrastructure overbuilds. Regardless of whether the bubble pops, there’s going to be real disillusionment, but in the long run AI will still be a transformative technology.

Let’s dive in.

Why bubbles?

Things feel a little crazy right now—valuations, marketing, rush to put “AI” on everything—and that’s to be expected. Virtually every transformative technology goes through a hype cycle, and we’re squarely in the “peak of inflated expectations” as defined by Gartner.

The AI companies recognize this and are using hype as a business tool to allow them to continue raising huge amounts of money for as long as possible. The goal: survive the crash and initiate the slope of enlightenment by making a breakthrough before funding runs out.

AI has two additional elements that bring the hype levels even higher:

It requires expensive infrastructure buildout, which brings in Perez’s theory of installation-deployment: installation involves a finance-led frenzy and over-investment in infrastructure that ends in a crash; after a turning point and realignment, deployment sees economy-wide diffusion and productivity gains

It’s the first technology where it feels like there might be a path to significantly compress the trough: AI could spur a research productivity flywheel that shortens iteration cycles through faster coding and discovery

How bubbles pop

Eventually the hype dies as the technology fails to live up to inflated expectations; a crash follows and we enter the “trough of disillusionment”. This crash often comes with the popping of a bubble, which can occur in two distinct ways1:

Valuation bubbles pop when overpriced companies collapse due to weak fundamentals

Infrastructure bubbles pop when overbuilt capacity far exceeds demand

The dot-com era is a classic example of a valuation bubble, and the 1990s telecom build-out followed an infrastructure bubble.

Looking at these past technology cycles2 helps illuminate how AI has potential for both.

A brief history

The two kinds of bubbles correspond with different technology cycle types: infrastructure buildouts and software-led tech.

Infrastructure Buildouts

Telecommunications (late 1990s): Telecom companies expected unlimited demand but built too fast and capacity went unused; the cheap bandwidth that remained was used to power the cloud + mobile revolutions

Railroad (early 1870s): Subsidized “essential” railroads were built far too quickly, and with profit a long way out, funding dried up; the important lines survived and the US benefitted heavily from them

Software-led Tech

Dot-com (mid 1990s-2002): Hype for the internet outweighed the need for presently strong financials, but shallow business models eventually failed; it wasn’t until later that massively profitable e-commerce, SaaS, and ads businesses emerged

Mobile Phones (early 2000s)3: Having “the internet in your pocket” was supposed to “change everything”, but the technology wasn’t ready; several years later the real revolution actually began with the iPhone 3GS

Not every hype cycle has an associated major bubble pop (e.g. mobile phones), but those that do are either an infrastructure bubble or a valuation bubble. AI is unique because there’s clear potential for both; inflated company valuations could crash and/or we could have a significant amount of excess data center capacity.

Is it a bubble?

I don’t think we’re in a bubble yet, but the current direction of travel raises concern4.

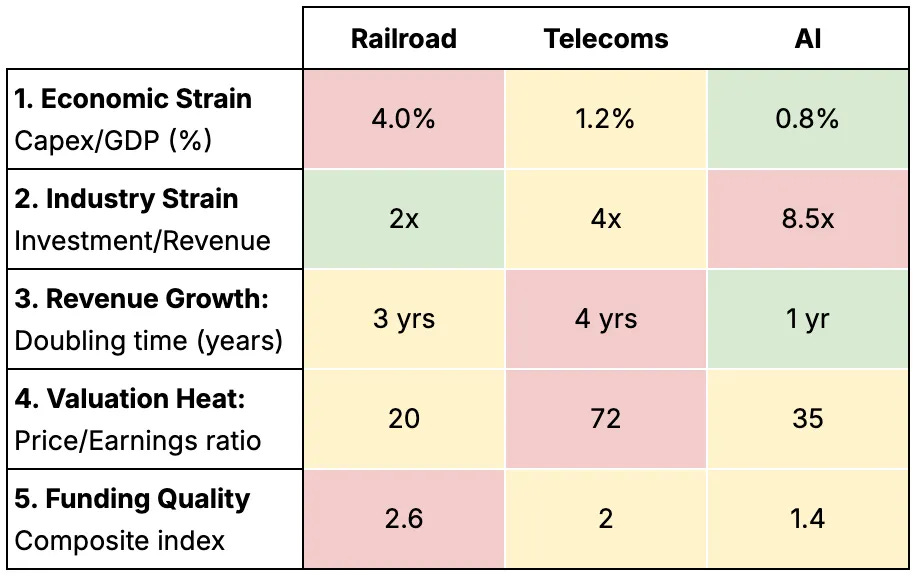

The analysis I find most helpful for understanding the current state + trend is Exponential View’s “gauge” framework. It uses five indicators that can be monitored and compared across current + historical situations to evaluate bubble risk; two reds = trouble, three reds = imminent trouble.

We’re already seeing slowdowns in progression of AI and these indicators have worsened from September to now5, so unless a major breakthrough comes soon it’s unlikely that the technology will live up to inflated expectations. We probably have significant work left to do and will go through a proper trough of disillusionment—which could either be associated with a bubble pop or a slow deflation.

If there is an imminent pop, it feels more likely to be from a valuation bubble than an infrastructure bubble. Data center construction will take years and capacity can be used in ways that don’t depend on demand (model training, continuous learning) while valuations and financial performance respond much more quickly.

The playbook

Bubble or not, I believe that AI will ultimately be a generational technology—even if it takes longer than expected and doesn’t look exactly like what we’re working with today. The path might vary but the destination will be the same, so individuals and companies should take action accordingly.

Some of my personal recommendations:

For individuals

Become extremely proficient at using AI tools, regardless of your domain—it might be more relevant than you think (Claude Code is for more than just code)

Develop taste—for design, for software, for writing, for analysis—discerning quality of AI-generated [insert_artifact] will be a valuable skill for a long time

Learn to learn, and learn often + diversely—learning is one of the highest leverage things you can do, and being able to learn effectively ensures you stay relevant regardless of how AI disruption shakes out

For companies

Don’t ignore AI transformation, but start with real business problems rather than “shiny object” gen AI initiatives; there’s still a ton of uncaptured value in core data infrastructure + predictive AI

Build a culture that’s as strongly AI-native as possible (within industry-specific compliance boundaries); Shopify is a nice north star

Remember the bitter lesson; start simple and build solutions that scale as models improve, rather than being made obsolete by the next update

The split between infrastructure and valuation bubbles refers to the mechanics through which bubbles form and pop; Stratechery put together a much deeper analysis that splits bubbles by benefit, which can span across the two types I laid out.

I found it helpful to understand past cycles in more detail than what I have space to show in this article; see here my extended notes.

Mobile phones arguably involved some infrastructure building as well, but infrastructure wasn’t the primary mechanism for hype.

This position is (intentionally) more about timing than a binary yes/no; as mentioned in the intro, my intent isn’t to make a super strong claim.

Full breakdown of the changes from September to now (live dashboard):

Industry Strain (Capex/GDP): 0.9% (green) → 0.8% (green)

Industry Strain (Investment/Revenue): 6x (yellow) → 8.5x (red)

Revenue Growth (doubling time): 1 year (green) → 1 year (green)

Valuation Heat (Price/Earnings): 32 (green) → 35 (yellow)

Funding Quality (Composite index): 1.1 (green) → 1.4 (yellow)